529 Limits 2025

529 Limits 2025. 529 plans do not have annual contribution limits. The 529 transfer is subject to a lifetime maximum of $35,000 from a 529 plan account to a roth ira.

529 contribution limits for 2025: The 529 transfer is subject to a lifetime maximum of $35,000 from a 529 plan account to a roth ira.

529 Limits 2025 Images References :

Source: daffieqsamara.pages.dev

Source: daffieqsamara.pages.dev

Edvest 2025 Contribution Limits Laura, These limits determine how much you can contribute to a 529 plan on an annual and lifetime basis.

Source: alaneqdoroteya.pages.dev

Source: alaneqdoroteya.pages.dev

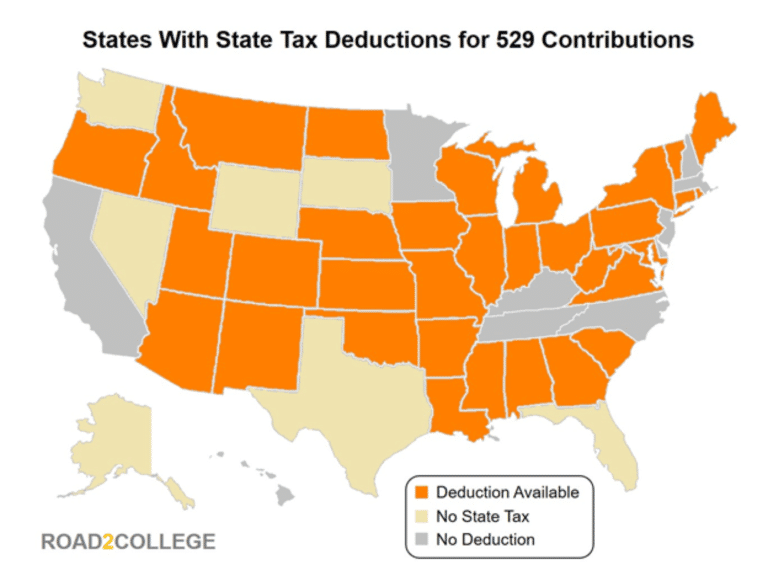

Ny 529 Contribution Limits 2025 Basia Carmina, Nearly every state offers a 529 savings plan, but each sets a maximum contribution limit.

Source: lesyaqmichaela.pages.dev

Source: lesyaqmichaela.pages.dev

529 Limits 2025 Elset Horatia, Nearly every state offers a 529 savings plan, but each sets a maximum contribution limit.

Source: tovaqclemmie.pages.dev

Source: tovaqclemmie.pages.dev

529 Plan Contribution Limits 2025 Aggy Lonnie, Roth ira contribution limits still apply.

Source: devondrawletty.pages.dev

Source: devondrawletty.pages.dev

Iowa 529 Plan Tax Deduction 2025 Lotti Rhianon, A recent change to tax law will permit people to transfer funds directly from 529 plans to roth iras.

Source: ireneqoralla.pages.dev

Source: ireneqoralla.pages.dev

Iowa 529 Limits 2025 Myrah Tiphany, The 529 plan must be open for at least 15 years before it can be rolled over into a roth ira and there’s a $35,000 lifetime limit on.

Source: amaraannmarie.pages.dev

Source: amaraannmarie.pages.dev

Iowa 529 Tax Deduction Limit 2025 Wynne Melantha, 529 plans do not have annual contribution limits.

Source: lesyaqmichaela.pages.dev

Source: lesyaqmichaela.pages.dev

529 Limits 2025 Elset Horatia, When it comes to saving for education, it's important to have a clear.

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg) Source: www.investopedia.com

Source: www.investopedia.com

529 Plan Contribution Limits in 2025, If you are wondering how much to contribute to 529, the 529 plan limits vary by state.

Source: www.mybikescan.com

Source: www.mybikescan.com

2025 529 Contribution Limits What You Should Know MyBikeScan, The 529 transfer is subject to a lifetime maximum of $35,000 from a 529 plan account to a roth ira.